Start your day with what's moving markets in Asia. Sign up here to receive our newsletter.

The rise of the machines is coming.

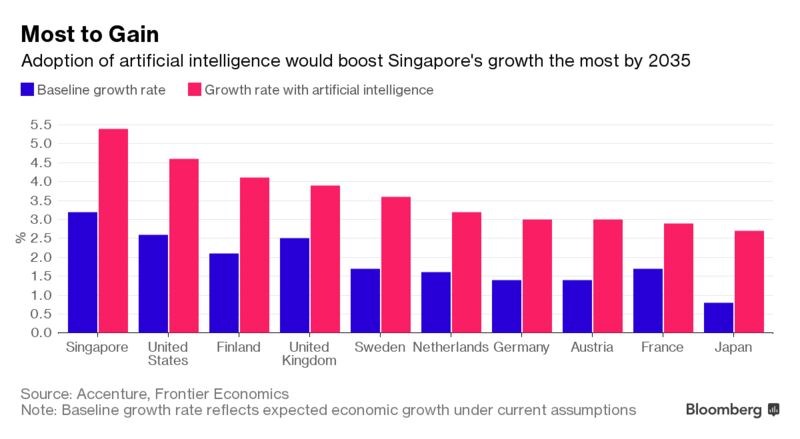

In technology-proficient Singapore, their integration into the economy could help the domestic growth rate to almost double and significantly lift labor productivity, according to a report by consultancy Accenture.

It found that artificial intelligence, once fully adopted, might lift Singapore’s annual growth rate to 5.4 percent in 18 years. That would be the largest increase among 33 countries studied and would translate into an additional $215 billion in gross value added. Without AI, the economy is predicted to expand 3.2 percent.

Accenture, Frontier Economics

“As Singapore advances its smart nation vision, the adoption of AI will propel economic growth and potentially serve as a powerful remedy for stagnant productivity and labor shortages,” said Lee Joon Seong, Southeast Asia managing director of Accenture Analytics.

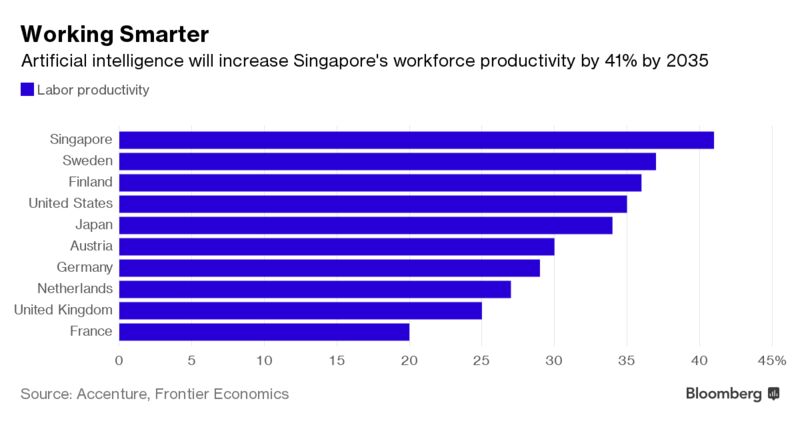

Machines would allow workers to use their time more effectively and focus on innovation, according to the report. They would also allow countries to tackle problems presented by a shortage of workers due to an aging workforce, it said.

Singapore's drive to become a global high-tech hub has seen the government, agencies, and companies actively encourage the study and implementation of technology across industries. Current uses range from self-driving buses and taxis to robots assisting the elderly with exercise. Recently, the government has also begun to place greater emphasis on developing artificial intelligence and data analytic capabilities.

Accenture, Frontier Economics

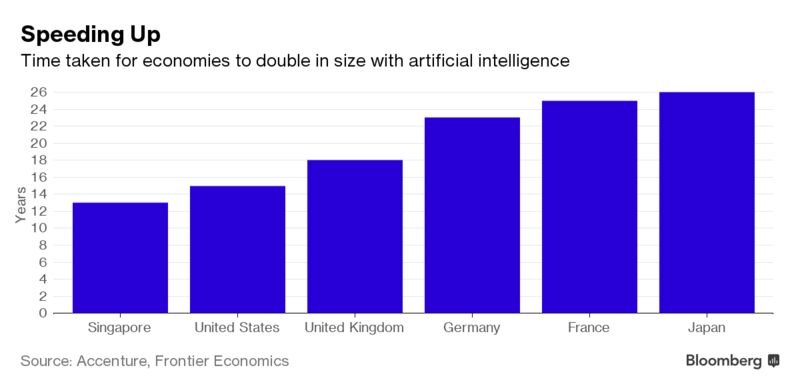

Higher labor productivity and faster growth would slash the time needed to double the size of Singapore's economy: the report finds full absorption of AI could see the city-state's GDP double in just 13 years, compared with 22 estimated without AI.

Comments

Post a Comment