ehan Chu says he’s got an early-mover advantage that will help his cryptocurrency fund stand out from the crowd.

The Hong Kong-based former art adviser started investing in bitcoin in 2013, when the digital asset saw its first major rally. Since then, prices have quadrupled, enabling Chu to quit his job, start a venture capital firm investing in blockchain technologies last year -- and now, launch a cryptocurrency fund that’s seeking to raise $100 million. Part of that money is already in the bank and Chu has started investing.

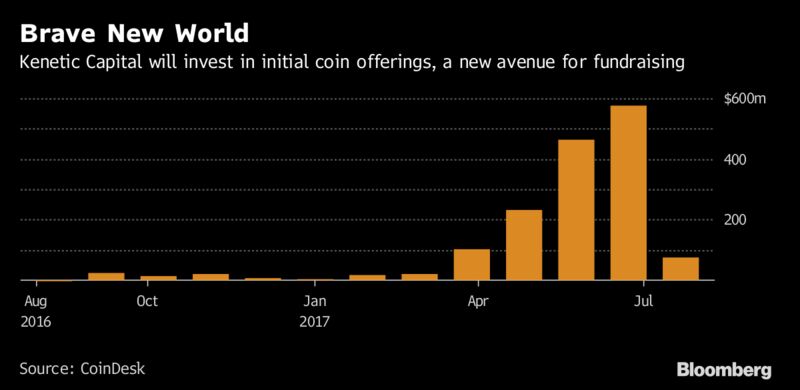

His Kenetic Capital is among a slew of firms that are lining up at the new frontier after soaring prices and proliferation of initial coin offerings -- sold by corporates to raise money -- boosted demand for digital assets. Chu, whose fund is advised by ethereum co-founder Vitalik Buterin, says he isn’t interested in speculation, but rather in tokens sold by companies with strong fundamentals and long-term potential.

“When we make a call for what we think is a good investment, it’s not because we think it’s a speculative play,” Chu said in an interview in Hong Kong. “It’s because we’re looking at the fundamentals based on years of experience.”

While the largest cryptocurrencies have all seen eye-popping rallies this year, it’s also a volatile market, prone to hacking and regulatory changes. One of the most salient issues now, for instance, is whether ICO tokens -- which CoinDesk data show have raised $1.8 billion for startups so far -- will be subject to securities regulations.

A rally in bitcoin has stalled after its price reached a record high last week, although it rose 1.4 percent Thursday to $4,192.207. And bigger swings may be on the horizon as the cryptocurrency -- which already split into two in August amid infighting over the underlying technology -- may see another bifurcation soon.

Still, many finance professionals are taking advantage of increased demand. Lewis Fellas, a former portfolio manager at Harvard University’s endowment fund, is seeking to raise $200 million for a cryptocurrency hedge fund, Bloomberg News reported last week. And technology billionaire Mark Cuban is investing in 1confirmation, a fund that plans to raise $20 million to invest in blockchain-based companies.

Chu’s Cayman Islands-registered cryptocurrency fund has drawn experience from Wall Street. His partners are Stephan Verhelst, former managing director in investment banking at HSBC Holdings Plc, and Lawrence Chu, co-founder of BlackPine Private Equity Partners and former fund manager at UBS O’Connor. Jehan Chu himself was a developer at Sotheby’s before becoming an art adviser to wealthy investors.

Chu said his clients mostly comprise of family offices and wealth angel investors. Kenetic Capital offers protection against hacking, offers hedge fund strategies and early access to ICOs, he added. The fund charges a traditional 2-and-20 fee structure.

“We have a different level of access to tokens than the average person off the street,” Chu said. “We have relationships and we add value to these teams and these businesses and companies that we’re committed to longer term.”

Comments

Post a Comment