- Bitcoin shot above $3,000 to a record high of $3,360.87, more than tripling in value for the year.

- The gains came despite this week's split in the digital currency into bitcoin and bitcoin cash.

- Bitcoin cash, which trades at a fraction of bitcoin's price, fell further Saturday amid a hack on its network.

-

Bitcoin leaped more than 16 percent Saturday into record territory, significantly strengthening against its offshoot "bitcoin cash" amid a hack on the new currency's network.

Bitcoin hit an all-time high of $3,360.87 Saturday, according to CoinDesk, before paring its gains slightly to hover near $3,303, with a market capitalization of more than $54 billion.

The digital currency has now more than tripled in value for the year, and gained about 15 percent in the first few days of August. Bitcoin has broken free of the trading range it's held ever since reaching its prior record of $3,025 in mid-June.

Ari Paul, CIO of BlockTower Capital, attributed the gains to a relief rally after a "relatively uneventful" split, as well as new investors buying bitcoin.

"With SegWit activation and the hard fork in the rear view mirror, bitcoin buyers see a smooth road ahead for the next two months," he told CNBC in an email, referring to a more popular upgrade proposal called Segregated Witness.

Another digital currency, ethereum, climbed more than 12 percent to $250 Saturday afternoon, according to CoinDesk.

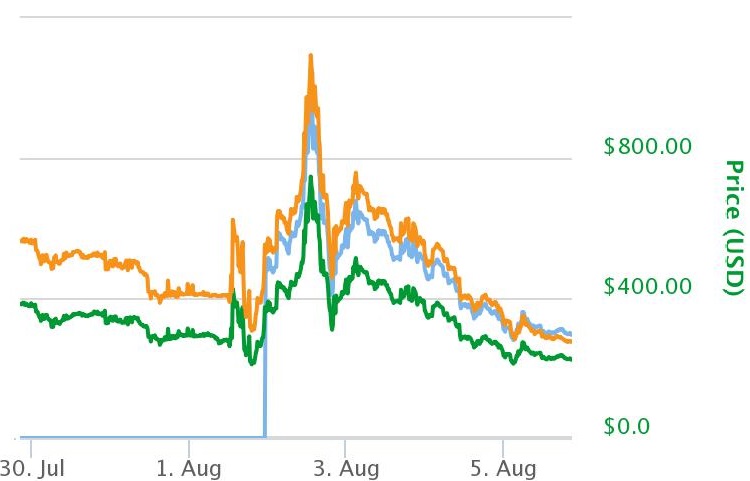

Bitcoin one-week performance

Source: CoinDesk

On Tuesday, Bitcoin split into bitcoin and bitcoin cash when a minority of developers went ahead with an alternative upgrade proposal. Investors holding bitcoin at the time of the split should have received an equal amount of bitcoin cash, and were able to trade it Tuesday. However, some major exchanges only began accepting bitcoin cash deposits Thursday and Friday.

ViaBTC, the Chinese exchange that's been the main proponent for bitcoin cash, tweeted at 4:03 a.m. that it temporarily suspended withdrawals due to a " transaction malleability attack" on the bitcoin cash network.

ViaBTC tweeted at 8:44 a.m. that it resumed withdrawals.

Bitcoin cash plunged nearly 36 percent Friday, falling about 9 percent to overnight to a low of $212. It recovered slightly to $223 Saturday afternoon, according to CoinMarketCap.

Bitcoin cash 1-week performance

Source: CoinMarketCap

Bitcoin Magazine pointed out Saturday morning that ViaBTC mining activity — which creates more of a digital currency — for bitcoin cash dropped to a tenth of what it was in the last few days, while most of the mining activity was concentrated on the original bitcoin.

Source: https://www.cnbc.com/2017/08/05/bitcoin-surges-above-3k-to-record-more-than-tripling-this-year.html

Isn’t it absurd that nearly 326 million people representing 80% of the adult population in Africa do not have access to bank accounts? This wretched situation denies countless of people financial freedom in the so-called dark continent. Bureaucratic tenors and economic exclusion inter alia have paved the way for the current phenomenon. Last year a study of 10 African nations with unusual inflationary ratio had South Sudan registering an unimaginable inflation rate of 295 percent. Egypt had the slightest with 12.30 percent. African governments continue to plunder the riches of the African people through Inflation. This makes it considerably insurmountable for individuals to conserve their resources. Moreover, public sector borrowing has crowded out the efficient private sector that can put credit to good use. The IMF estimates that averagely credit to the private sector is estimated at 30 percent of GDP in Sub-Sahara Africa. CCN spoke to Werner van Rooyen, Head of Business Develo...

Comments

Post a Comment